Bad Debt Expense Balance Sheet - Recording bad debt involves a debit and a credit entry. A debit entry is made to a bad debt expense. The bad debt expense is a company’s outstanding receivables that were determined to be uncollectible and are thereby.

Recording bad debt involves a debit and a credit entry. The bad debt expense is a company’s outstanding receivables that were determined to be uncollectible and are thereby. A debit entry is made to a bad debt expense.

Recording bad debt involves a debit and a credit entry. A debit entry is made to a bad debt expense. The bad debt expense is a company’s outstanding receivables that were determined to be uncollectible and are thereby.

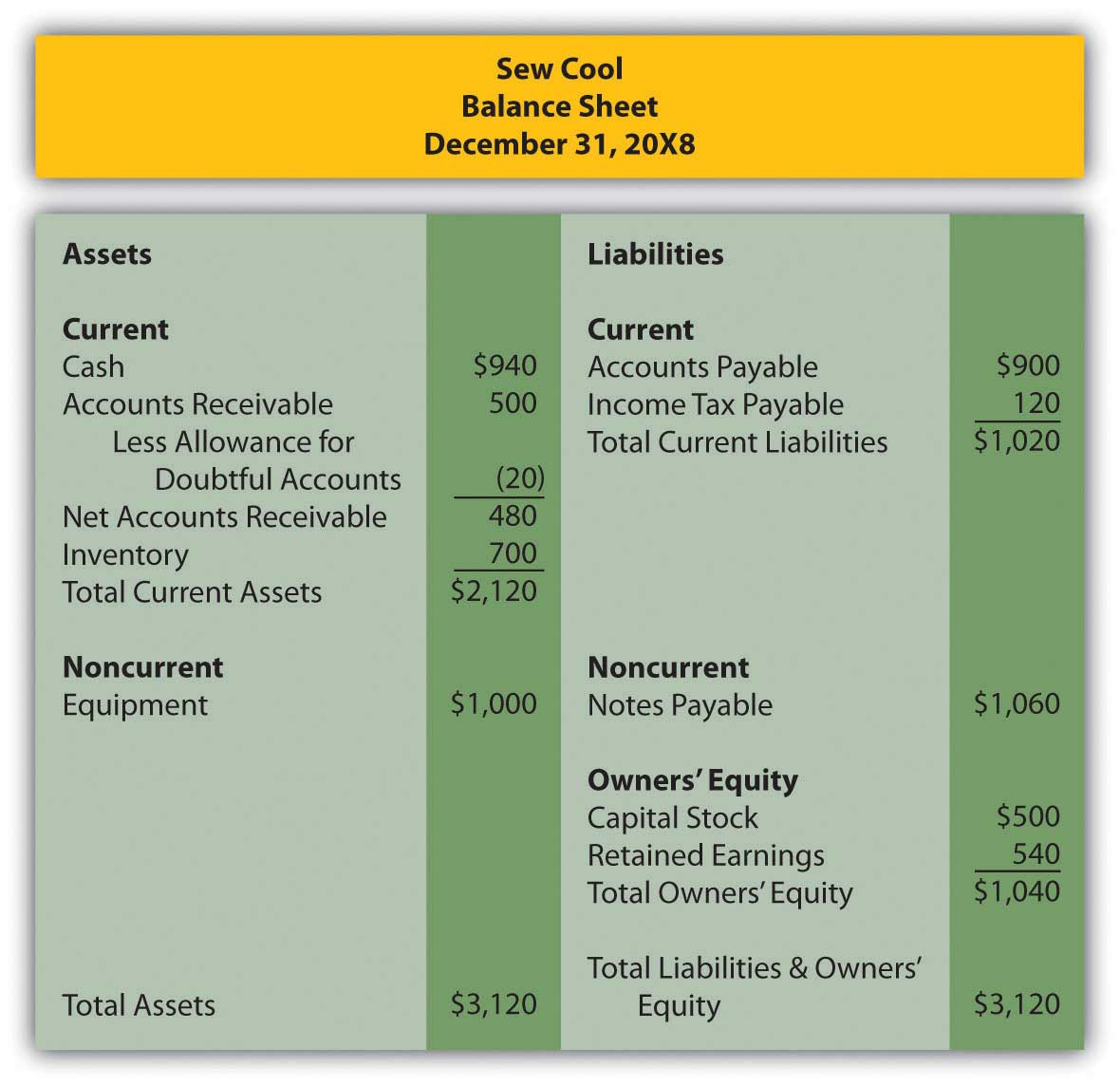

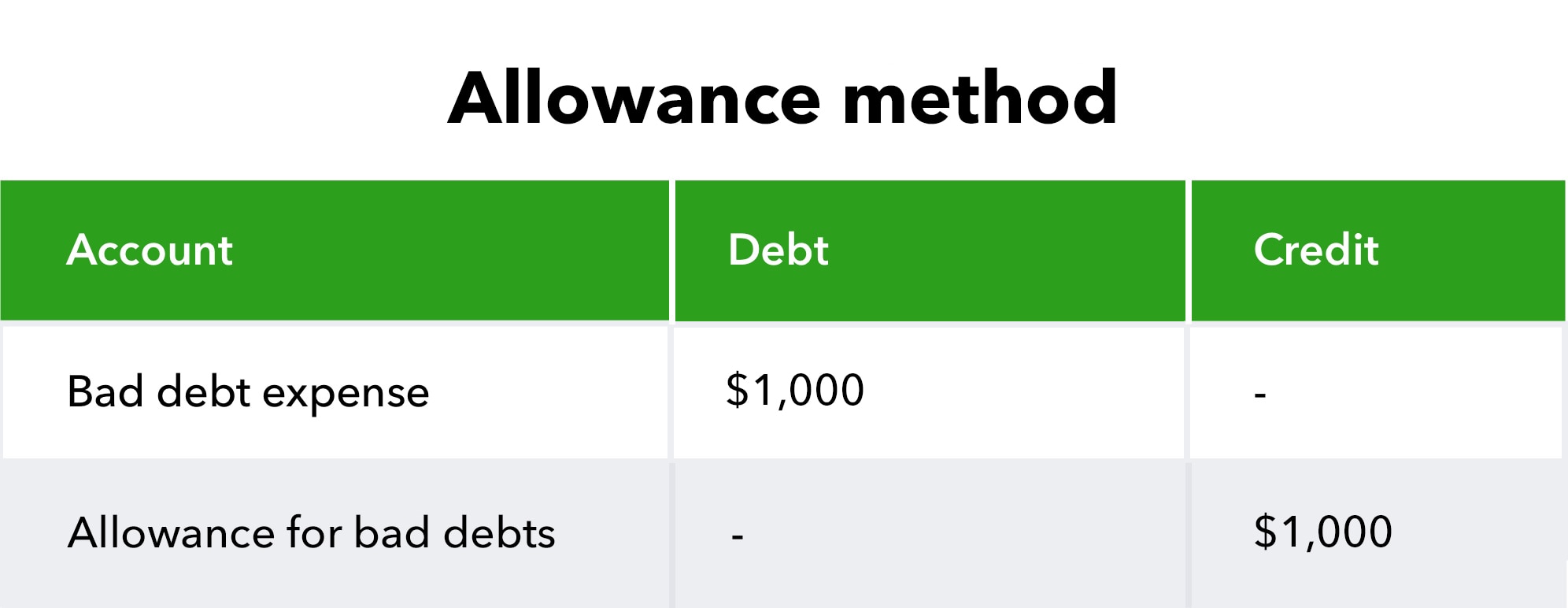

Allowance For Bad Debts

The bad debt expense is a company’s outstanding receivables that were determined to be uncollectible and are thereby. Recording bad debt involves a debit and a credit entry. A debit entry is made to a bad debt expense.

321 07 Bad Debt Expense Balance Sheet Approach YouTube

A debit entry is made to a bad debt expense. The bad debt expense is a company’s outstanding receivables that were determined to be uncollectible and are thereby. Recording bad debt involves a debit and a credit entry.

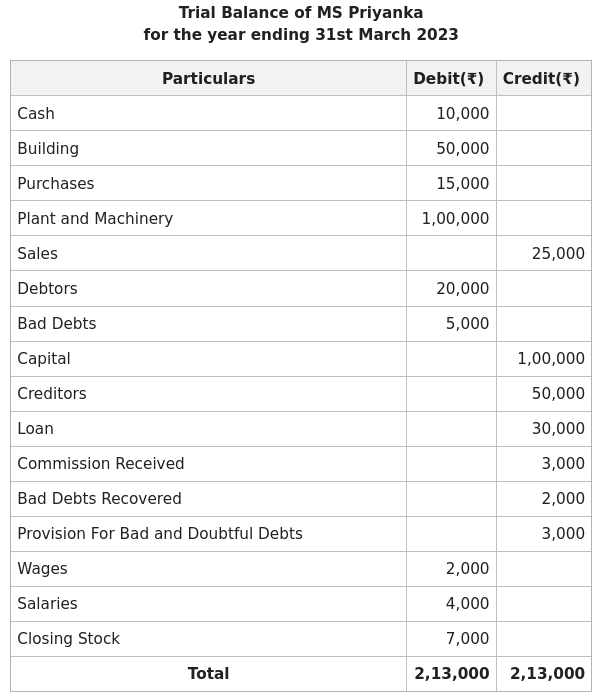

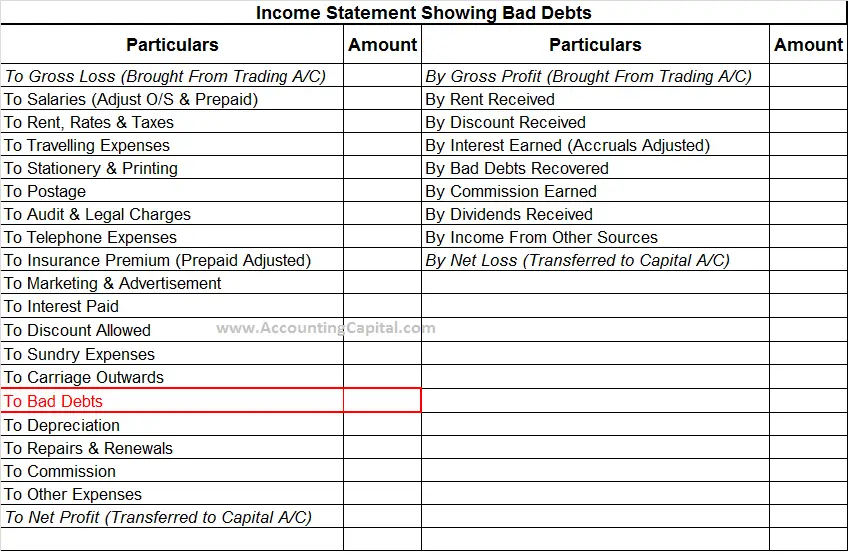

What are Bad Debts (Example, Journal Entry)? Accounting Capital

The bad debt expense is a company’s outstanding receivables that were determined to be uncollectible and are thereby. A debit entry is made to a bad debt expense. Recording bad debt involves a debit and a credit entry.

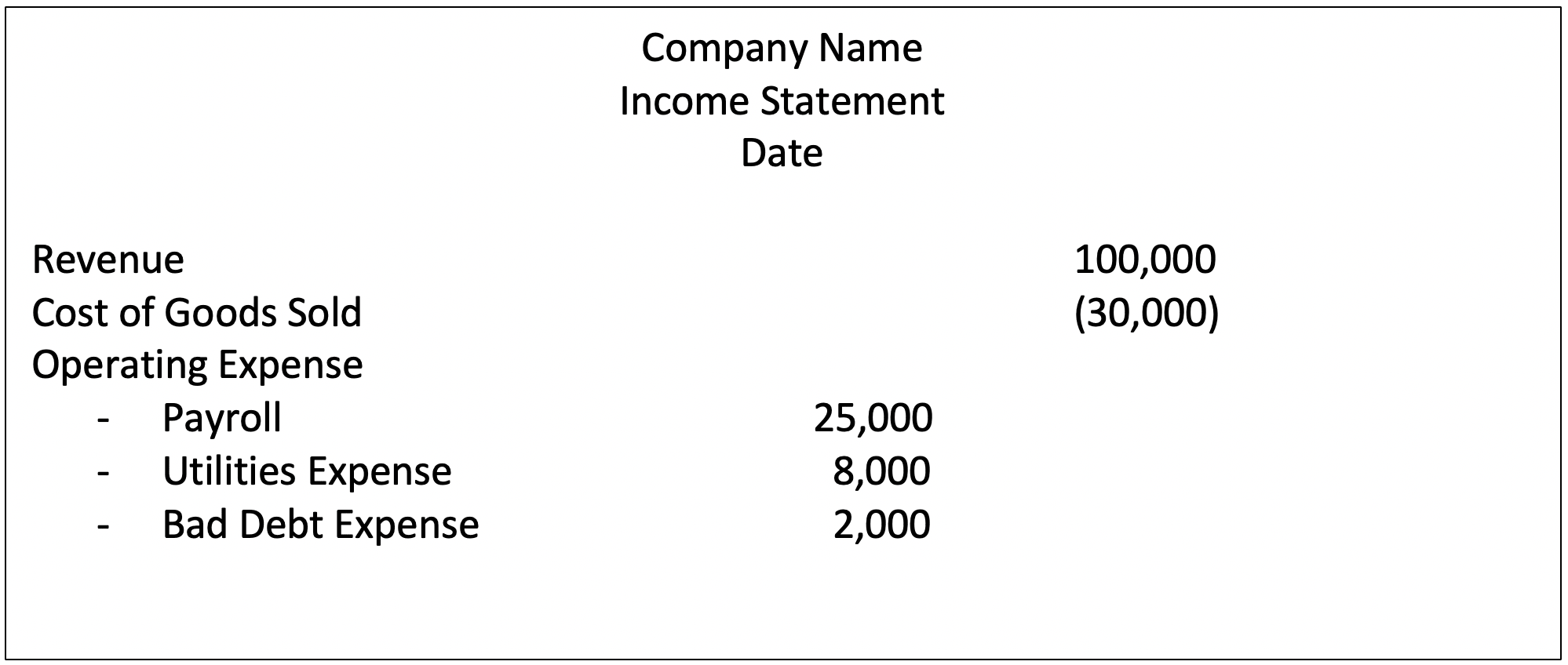

Adjusting Entries Bad Debt Expense

Recording bad debt involves a debit and a credit entry. A debit entry is made to a bad debt expense. The bad debt expense is a company’s outstanding receivables that were determined to be uncollectible and are thereby.

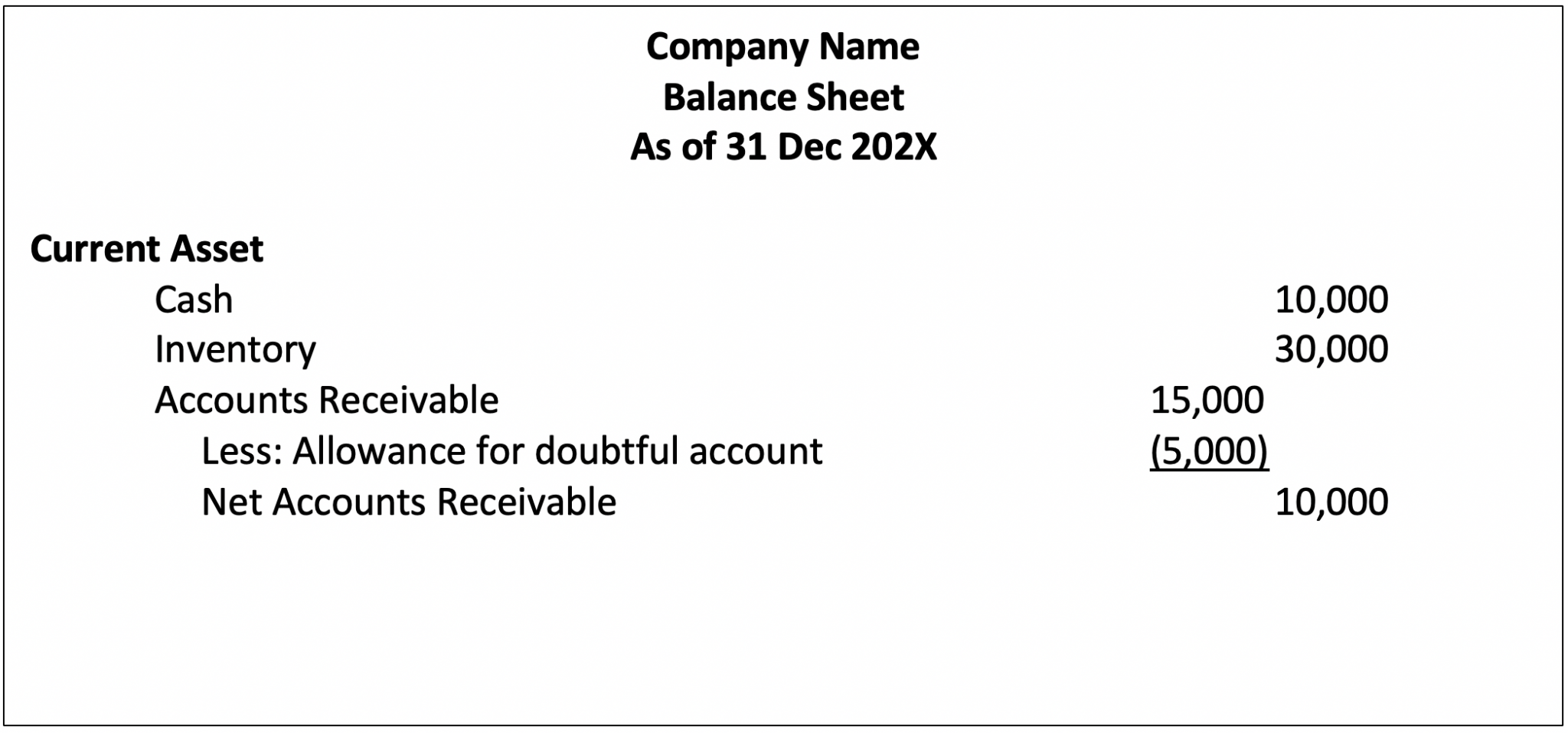

Bad Debt Expense and Allowance for Doubtful Account Accountinguide

Recording bad debt involves a debit and a credit entry. A debit entry is made to a bad debt expense. The bad debt expense is a company’s outstanding receivables that were determined to be uncollectible and are thereby.

How to calculate and record the bad debt expense QuickBooks Australia

The bad debt expense is a company’s outstanding receivables that were determined to be uncollectible and are thereby. Recording bad debt involves a debit and a credit entry. A debit entry is made to a bad debt expense.

How to Show Bad Debts in Balance Sheet?

A debit entry is made to a bad debt expense. The bad debt expense is a company’s outstanding receivables that were determined to be uncollectible and are thereby. Recording bad debt involves a debit and a credit entry.

Bad Debt Expense and Allowance for Doubtful Account Accountinguide

Recording bad debt involves a debit and a credit entry. A debit entry is made to a bad debt expense. The bad debt expense is a company’s outstanding receivables that were determined to be uncollectible and are thereby.

Bad Debt Expense Definition and Methods for Estimating

Recording bad debt involves a debit and a credit entry. The bad debt expense is a company’s outstanding receivables that were determined to be uncollectible and are thereby. A debit entry is made to a bad debt expense.

Recording Bad Debt Involves A Debit And A Credit Entry.

A debit entry is made to a bad debt expense. The bad debt expense is a company’s outstanding receivables that were determined to be uncollectible and are thereby.

:max_bytes(150000):strip_icc()/AmazonBS-33b2e9c06fff4e63983e63ae9243141c.JPG)