Bad Debts In Balance Sheet - Whatever they do with it, the difference between the debt on balance sheet and the amount they sell it for (or zero if they write it off themselves) is going to be a loss in that financial period. For example, abc ltd had debtors amounting to. It is shown on the debit. Treatment of “bad debt written off of rs.2ooo.” in trial balance: Provision for doubtful debts is shown in the debit side of the profit and loss account as well as shown as a deduction from sundry debtors in the assets side of the balance sheet. Banks do reserve for bad debts. By writing off a bad debt, the entity has recognized it lost. “bad debts recovered a/c” is a nominal account therefore debit all expenses and losses, and credit all incomes and gains. Debited to p&l a/c and charged as an expense. Now let me try to explain to you the.

Debited to p&l a/c and charged as an expense. Effects of provision for doubtful debts in financial statements: It is shown on the debit. “bad debts recovered a/c” is a nominal account therefore debit all expenses and losses, and credit all incomes and gains. By writing off a bad debt, the entity has recognized it lost. Whatever they do with it, the difference between the debt on balance sheet and the amount they sell it for (or zero if they write it off themselves) is going to be a loss in that financial period. Now let me try to explain to you the. Treatment of “bad debt written off of rs.2ooo.” in trial balance: Provision for doubtful debts is shown in the debit side of the profit and loss account as well as shown as a deduction from sundry debtors in the assets side of the balance sheet. For example, abc ltd had debtors amounting to.

Banks do reserve for bad debts. Effects of provision for doubtful debts in financial statements: It is shown on the debit. Provision for doubtful debts is shown in the debit side of the profit and loss account as well as shown as a deduction from sundry debtors in the assets side of the balance sheet. By writing off a bad debt, the entity has recognized it lost. Debited to p&l a/c and charged as an expense. “bad debts recovered a/c” is a nominal account therefore debit all expenses and losses, and credit all incomes and gains. Whatever they do with it, the difference between the debt on balance sheet and the amount they sell it for (or zero if they write it off themselves) is going to be a loss in that financial period. Now let me try to explain to you the. Treatment of “bad debt written off of rs.2ooo.” in trial balance:

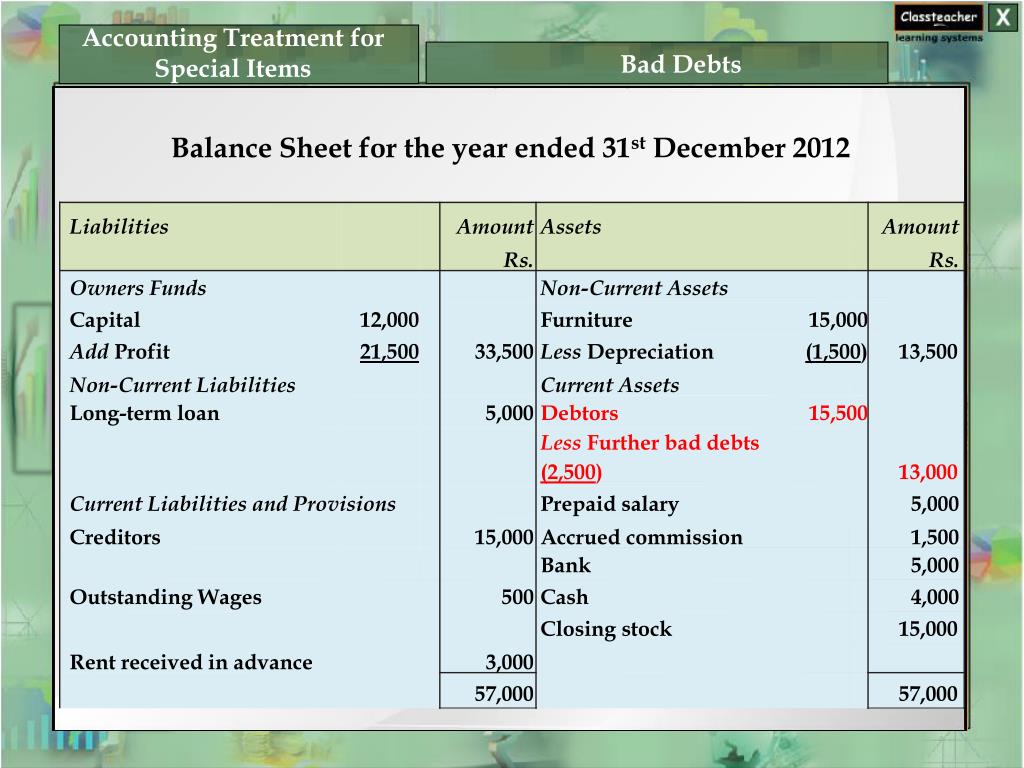

PPT Capital Receipt PowerPoint Presentation, free download ID5491041

Now let me try to explain to you the. For example, abc ltd had debtors amounting to. Debited to p&l a/c and charged as an expense. Effects of provision for doubtful debts in financial statements: By writing off a bad debt, the entity has recognized it lost.

Adjusting Entries Bad Debt Expense

Effects of provision for doubtful debts in financial statements: Debited to p&l a/c and charged as an expense. For example, abc ltd had debtors amounting to. Treatment of “bad debt written off of rs.2ooo.” in trial balance: Now let me try to explain to you the.

Adjustment of Bad Debts Recovered in Final Accounts (Financial

Provision for doubtful debts is shown in the debit side of the profit and loss account as well as shown as a deduction from sundry debtors in the assets side of the balance sheet. Effects of provision for doubtful debts in financial statements: Now let me try to explain to you the. Banks do reserve for bad debts. By writing.

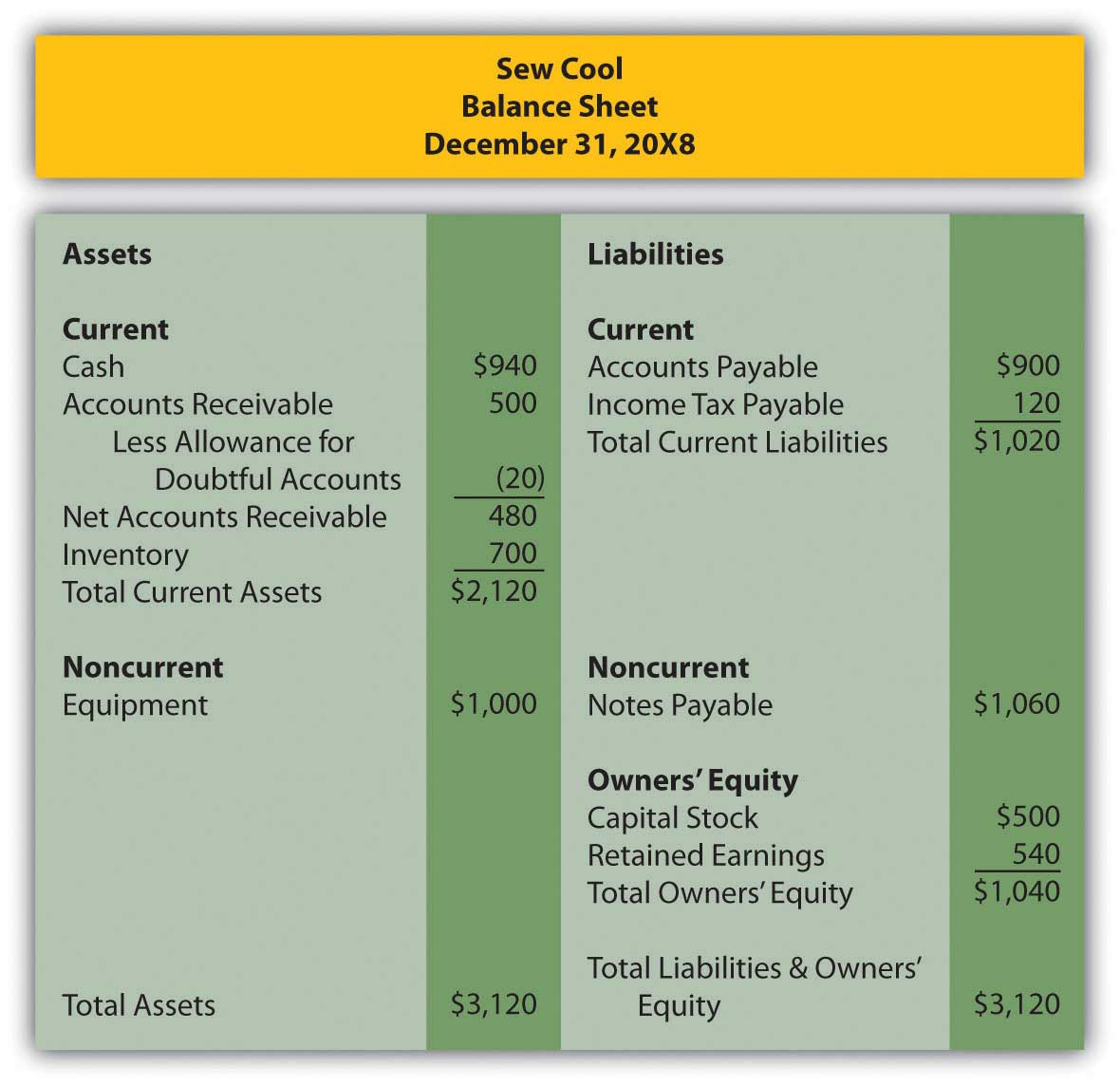

Bad Debt Expense Definition and Methods for Estimating

Effects of provision for doubtful debts in financial statements: Banks do reserve for bad debts. Whatever they do with it, the difference between the debt on balance sheet and the amount they sell it for (or zero if they write it off themselves) is going to be a loss in that financial period. For example, abc ltd had debtors amounting.

Beautiful Provision For Bad Debts In Statement Cash Flow Balance

Now let me try to explain to you the. Effects of provision for doubtful debts in financial statements: Whatever they do with it, the difference between the debt on balance sheet and the amount they sell it for (or zero if they write it off themselves) is going to be a loss in that financial period. “bad debts recovered a/c”.

Basics of Accounting/165/Where to show the Provision for Bad Debts in

Provision for doubtful debts is shown in the debit side of the profit and loss account as well as shown as a deduction from sundry debtors in the assets side of the balance sheet. Debited to p&l a/c and charged as an expense. It is shown on the debit. Treatment of “bad debt written off of rs.2ooo.” in trial balance:.

How to calculate and record the bad debt expense QuickBooks Australia

Effects of provision for doubtful debts in financial statements: “bad debts recovered a/c” is a nominal account therefore debit all expenses and losses, and credit all incomes and gains. Banks do reserve for bad debts. For example, abc ltd had debtors amounting to. Treatment of “bad debt written off of rs.2ooo.” in trial balance:

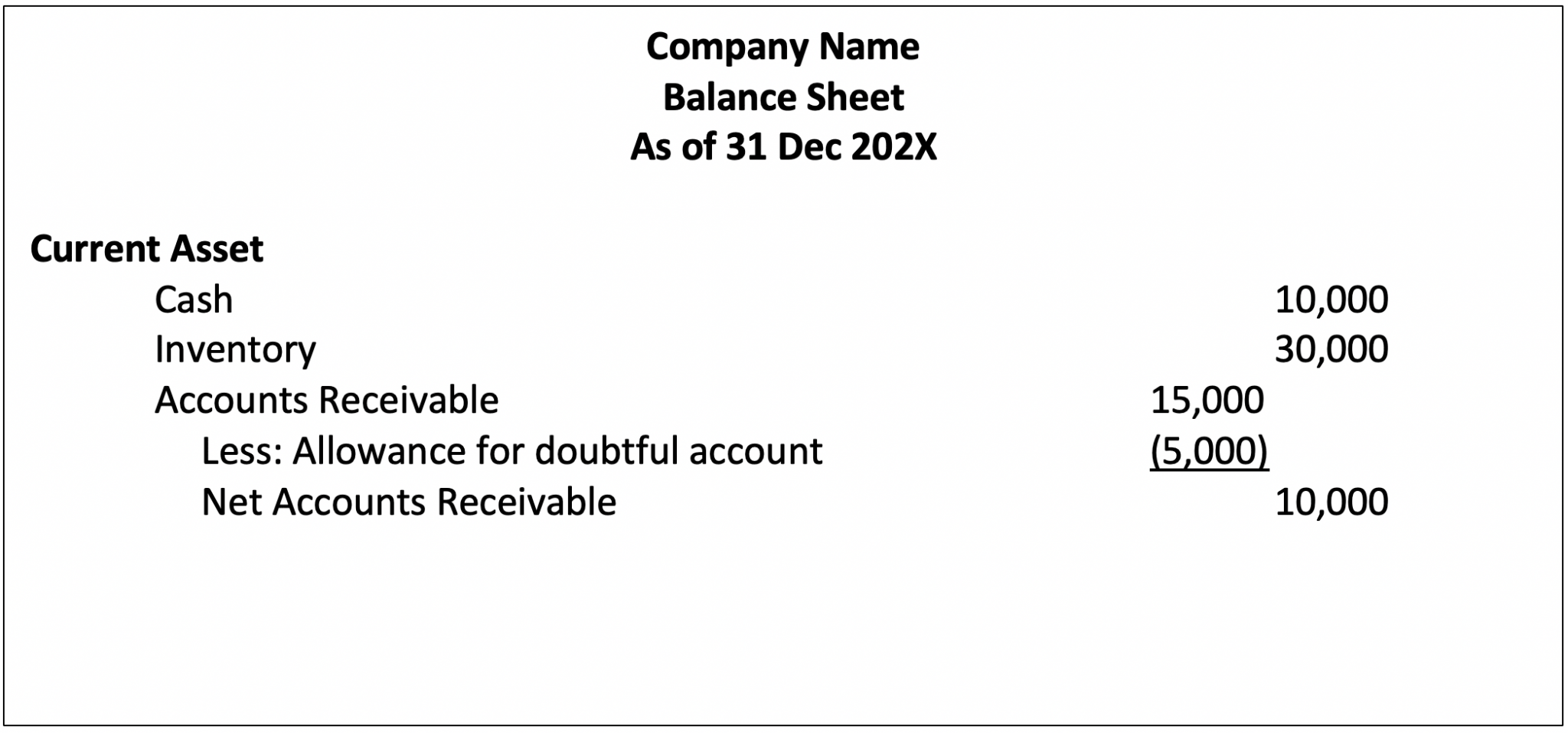

Bad Debt Expense and Allowance for Doubtful Account Accountinguide

Treatment of “bad debt written off of rs.2ooo.” in trial balance: Now let me try to explain to you the. Debited to p&l a/c and charged as an expense. Effects of provision for doubtful debts in financial statements: “bad debts recovered a/c” is a nominal account therefore debit all expenses and losses, and credit all incomes and gains.

Bad Debt Expense and Allowance for Doubtful Account Accountinguide

Banks do reserve for bad debts. Provision for doubtful debts is shown in the debit side of the profit and loss account as well as shown as a deduction from sundry debtors in the assets side of the balance sheet. Now let me try to explain to you the. Effects of provision for doubtful debts in financial statements: Whatever they.

How to Show Bad Debts in Balance Sheet?

It is shown on the debit. By writing off a bad debt, the entity has recognized it lost. “bad debts recovered a/c” is a nominal account therefore debit all expenses and losses, and credit all incomes and gains. Debited to p&l a/c and charged as an expense. Whatever they do with it, the difference between the debt on balance sheet.

Debited To P&L A/C And Charged As An Expense.

Effects of provision for doubtful debts in financial statements: It is shown on the debit. Banks do reserve for bad debts. Whatever they do with it, the difference between the debt on balance sheet and the amount they sell it for (or zero if they write it off themselves) is going to be a loss in that financial period.

Treatment Of “Bad Debt Written Off Of Rs.2Ooo.” In Trial Balance:

Provision for doubtful debts is shown in the debit side of the profit and loss account as well as shown as a deduction from sundry debtors in the assets side of the balance sheet. By writing off a bad debt, the entity has recognized it lost. For example, abc ltd had debtors amounting to. “bad debts recovered a/c” is a nominal account therefore debit all expenses and losses, and credit all incomes and gains.

:max_bytes(150000):strip_icc()/AmazonBS-33b2e9c06fff4e63983e63ae9243141c.JPG)