Balance Sheet Leverage Calculation - Leverage ratios determine the level of debt in relation to the size of the balance sheet. Financial leverage refers to the borrowing of capital by a corporation from lenders, such as banks, to fund its operations and long. On the balance sheet, leverage ratios measure the financial leverage on the balance sheet of the company, or the reliance a company has on.

Leverage ratios determine the level of debt in relation to the size of the balance sheet. Financial leverage refers to the borrowing of capital by a corporation from lenders, such as banks, to fund its operations and long. On the balance sheet, leverage ratios measure the financial leverage on the balance sheet of the company, or the reliance a company has on.

Leverage ratios determine the level of debt in relation to the size of the balance sheet. Financial leverage refers to the borrowing of capital by a corporation from lenders, such as banks, to fund its operations and long. On the balance sheet, leverage ratios measure the financial leverage on the balance sheet of the company, or the reliance a company has on.

Stock leverage calculator ArrinGreger

Financial leverage refers to the borrowing of capital by a corporation from lenders, such as banks, to fund its operations and long. On the balance sheet, leverage ratios measure the financial leverage on the balance sheet of the company, or the reliance a company has on. Leverage ratios determine the level of debt in relation to the size of the.

Peerless Balance Sheet Leverage Formula What Are Intangible Assets On A

Financial leverage refers to the borrowing of capital by a corporation from lenders, such as banks, to fund its operations and long. Leverage ratios determine the level of debt in relation to the size of the balance sheet. On the balance sheet, leverage ratios measure the financial leverage on the balance sheet of the company, or the reliance a company.

Leverage Ratios Closer Look at Financial, Operating, Combined

Financial leverage refers to the borrowing of capital by a corporation from lenders, such as banks, to fund its operations and long. On the balance sheet, leverage ratios measure the financial leverage on the balance sheet of the company, or the reliance a company has on. Leverage ratios determine the level of debt in relation to the size of the.

How To Calculate A Company's Leverage

Financial leverage refers to the borrowing of capital by a corporation from lenders, such as banks, to fund its operations and long. Leverage ratios determine the level of debt in relation to the size of the balance sheet. On the balance sheet, leverage ratios measure the financial leverage on the balance sheet of the company, or the reliance a company.

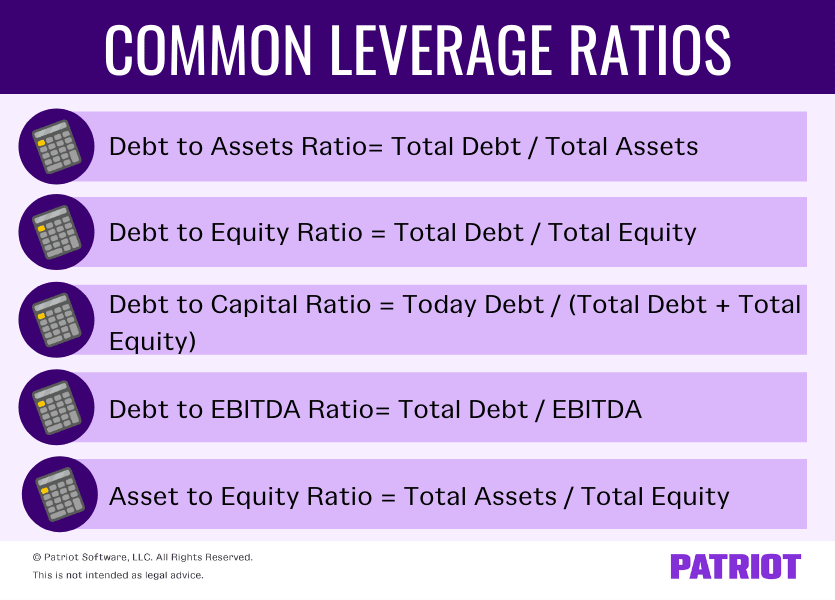

Leverage Ratios Debt/Equity, Debt/Capital, Debt/EBITDA, Examples

Leverage ratios determine the level of debt in relation to the size of the balance sheet. Financial leverage refers to the borrowing of capital by a corporation from lenders, such as banks, to fund its operations and long. On the balance sheet, leverage ratios measure the financial leverage on the balance sheet of the company, or the reliance a company.

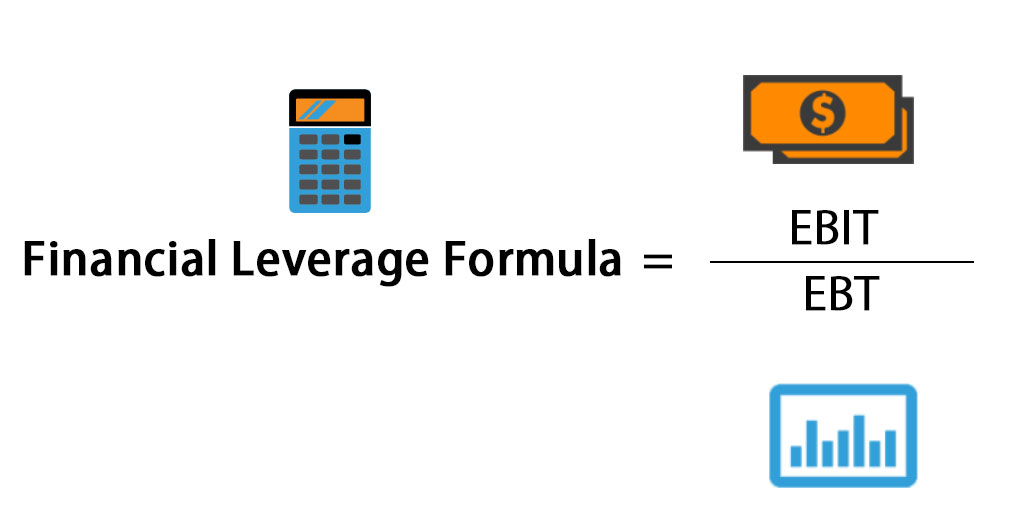

Financial Leverage Formula Calculator (Excel template)

On the balance sheet, leverage ratios measure the financial leverage on the balance sheet of the company, or the reliance a company has on. Leverage ratios determine the level of debt in relation to the size of the balance sheet. Financial leverage refers to the borrowing of capital by a corporation from lenders, such as banks, to fund its operations.

Fantastic Leverage Ratio Analysis And Interpretation Dividend Treatment

On the balance sheet, leverage ratios measure the financial leverage on the balance sheet of the company, or the reliance a company has on. Financial leverage refers to the borrowing of capital by a corporation from lenders, such as banks, to fund its operations and long. Leverage ratios determine the level of debt in relation to the size of the.

A Guide to Financial Leverage

On the balance sheet, leverage ratios measure the financial leverage on the balance sheet of the company, or the reliance a company has on. Leverage ratios determine the level of debt in relation to the size of the balance sheet. Financial leverage refers to the borrowing of capital by a corporation from lenders, such as banks, to fund its operations.

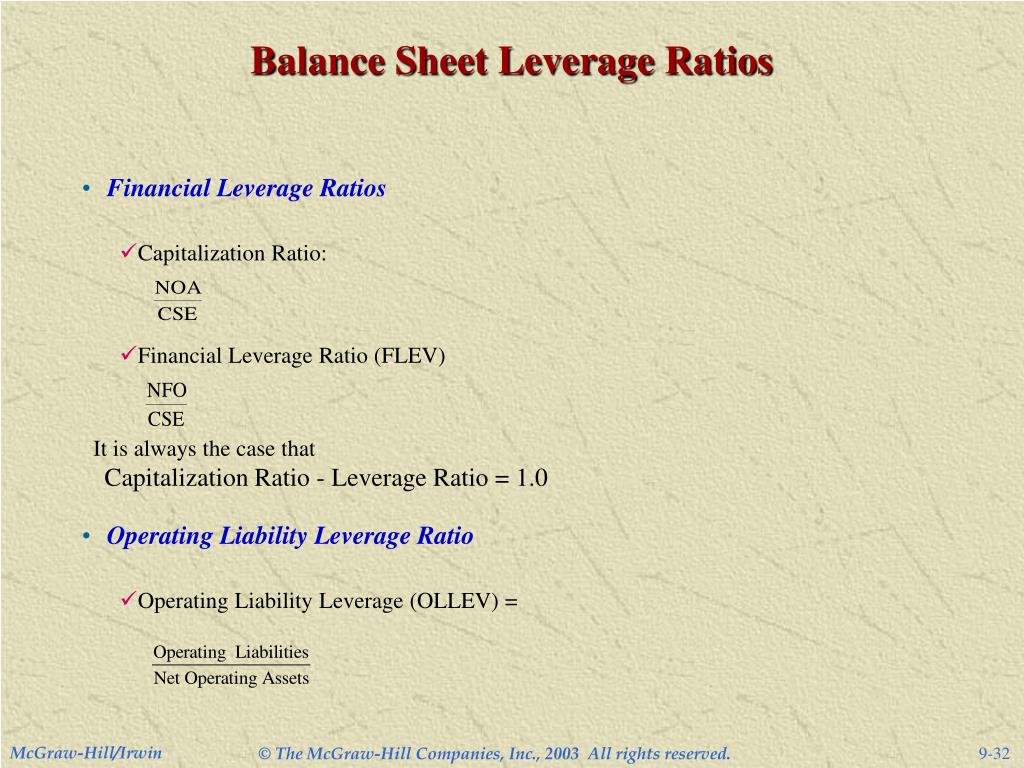

PPT Chapter 9 PowerPoint Presentation, free download ID6450262

Leverage ratios determine the level of debt in relation to the size of the balance sheet. Financial leverage refers to the borrowing of capital by a corporation from lenders, such as banks, to fund its operations and long. On the balance sheet, leverage ratios measure the financial leverage on the balance sheet of the company, or the reliance a company.

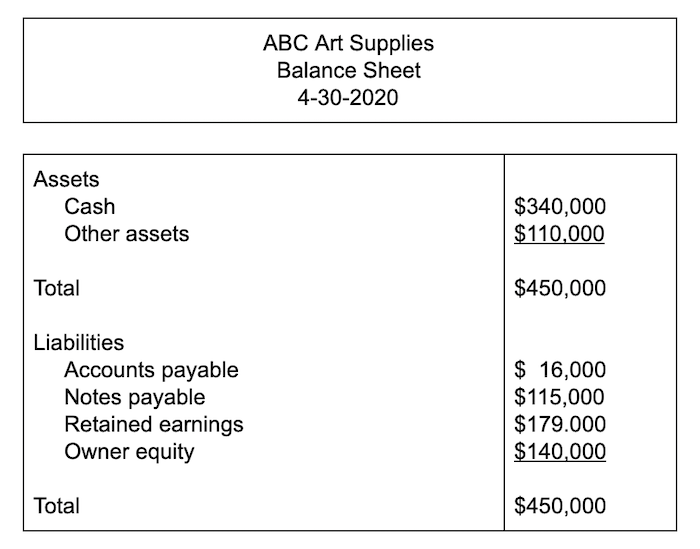

Chapter 15 Accounting

Financial leverage refers to the borrowing of capital by a corporation from lenders, such as banks, to fund its operations and long. Leverage ratios determine the level of debt in relation to the size of the balance sheet. On the balance sheet, leverage ratios measure the financial leverage on the balance sheet of the company, or the reliance a company.

Financial Leverage Refers To The Borrowing Of Capital By A Corporation From Lenders, Such As Banks, To Fund Its Operations And Long.

On the balance sheet, leverage ratios measure the financial leverage on the balance sheet of the company, or the reliance a company has on. Leverage ratios determine the level of debt in relation to the size of the balance sheet.