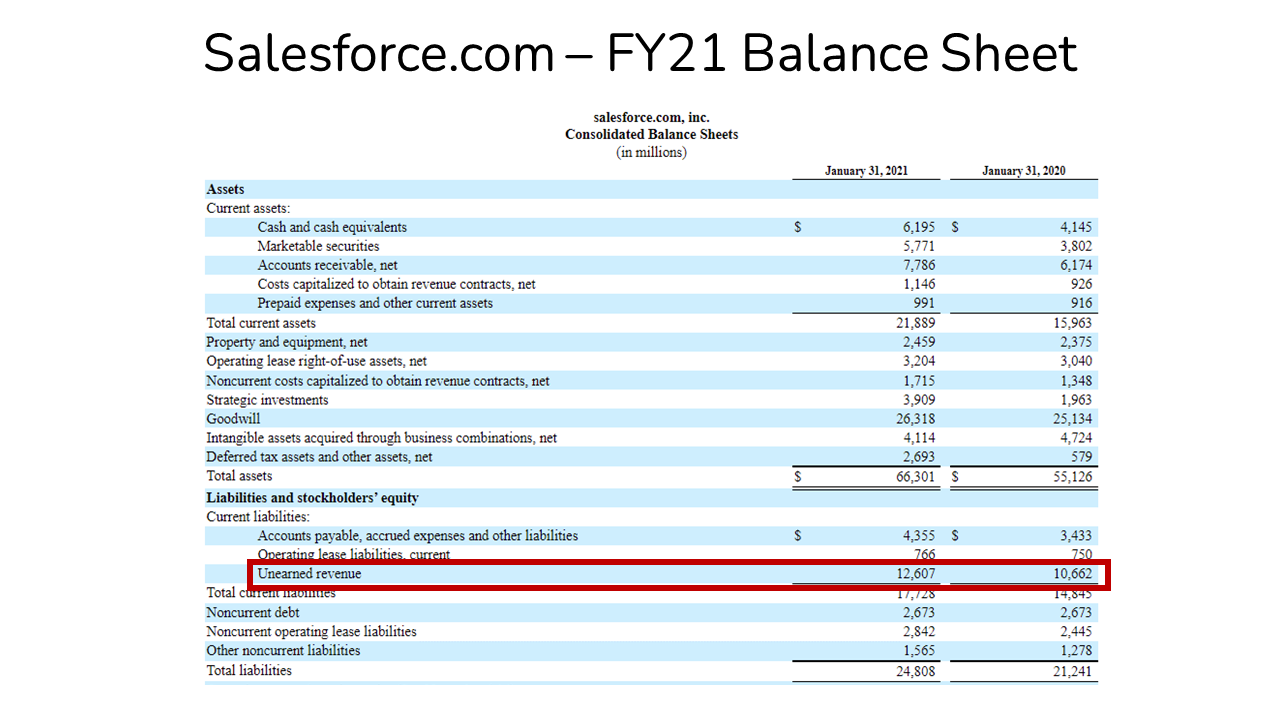

Does Deferred Revenue Go On The Balance Sheet - Deferred revenue appears on the balance sheet as a liability, reflecting obligations to deliver goods or services. How does deferred revenue impact a. Deferred revenue is recorded on the balance sheet as a liability because it represents a future obligation to deliver products or. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or.

Deferred revenue appears on the balance sheet as a liability, reflecting obligations to deliver goods or services. Deferred revenue is recorded on the balance sheet as a liability because it represents a future obligation to deliver products or. Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or. How does deferred revenue impact a. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until.

Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or. Deferred revenue is recorded on the balance sheet as a liability because it represents a future obligation to deliver products or. How does deferred revenue impact a. Deferred revenue appears on the balance sheet as a liability, reflecting obligations to deliver goods or services.

Deferred Revenue AwesomeFinTech Blog

Deferred revenue appears on the balance sheet as a liability, reflecting obligations to deliver goods or services. Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or. How does deferred revenue impact a. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation.

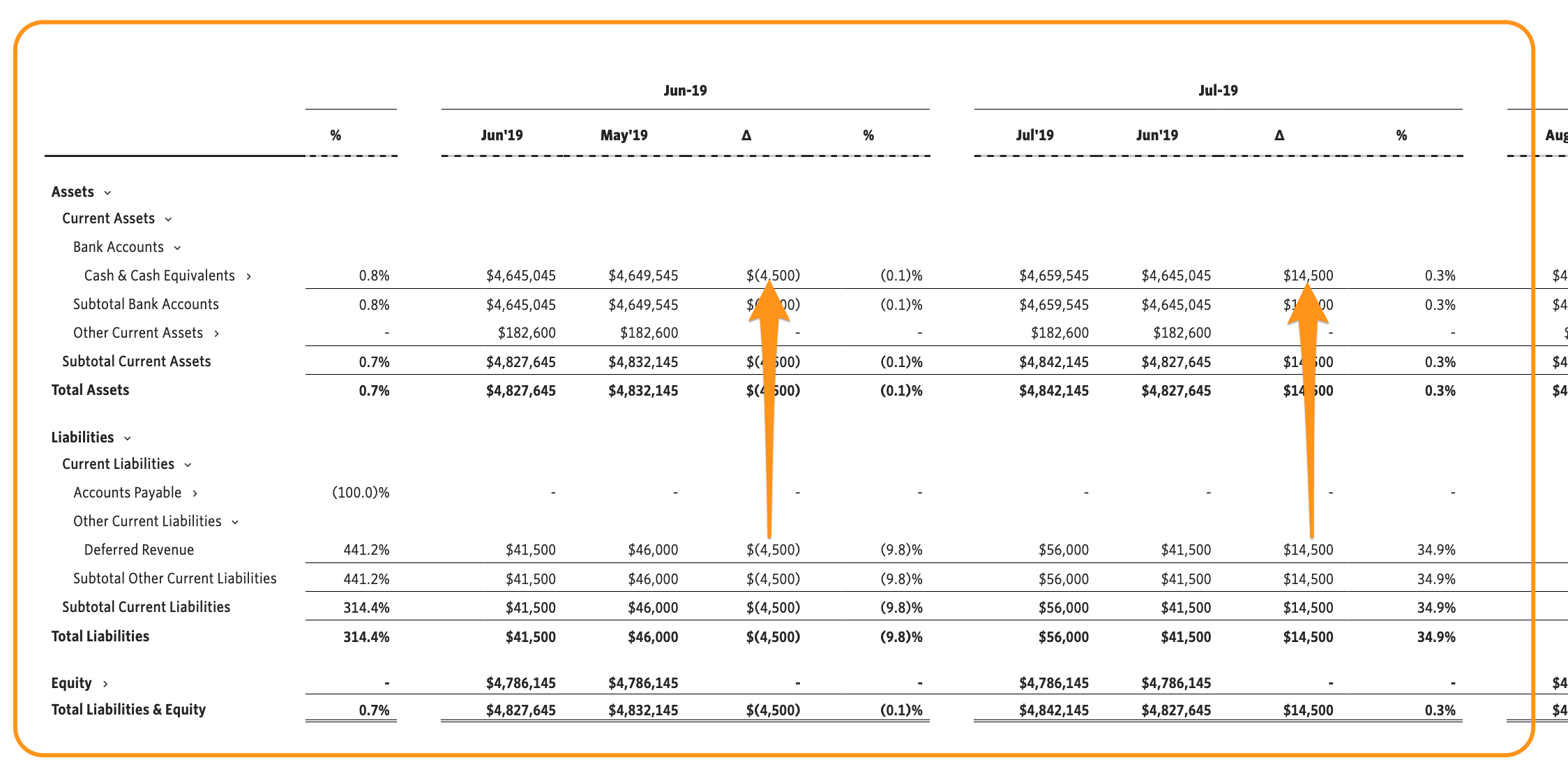

Simple Deferred Revenue with Jirav Pro

Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or. Deferred revenue appears on the balance sheet as a liability, reflecting obligations to deliver goods or services. How does.

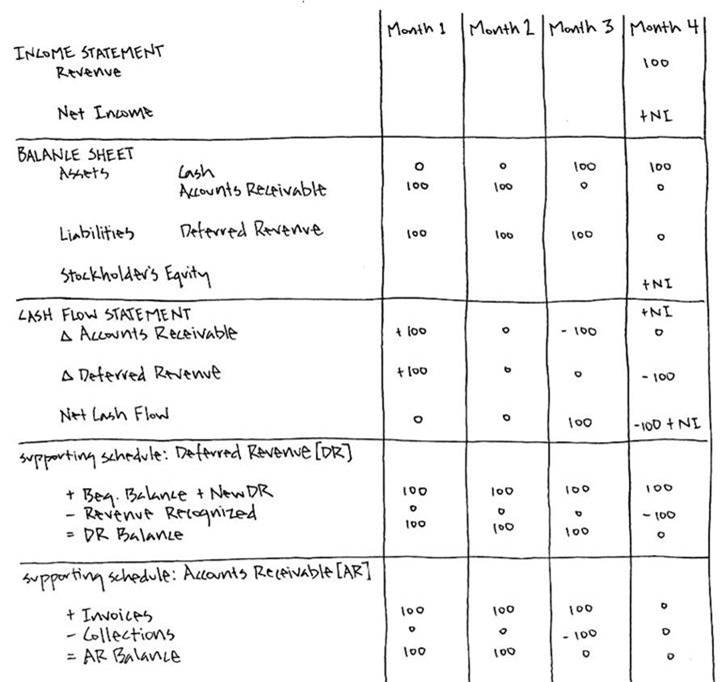

Deferred Revenue Debit or Credit and its Flow Through the Financials

Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or. Deferred revenue is recorded on the balance sheet as a liability because it represents a future obligation to deliver.

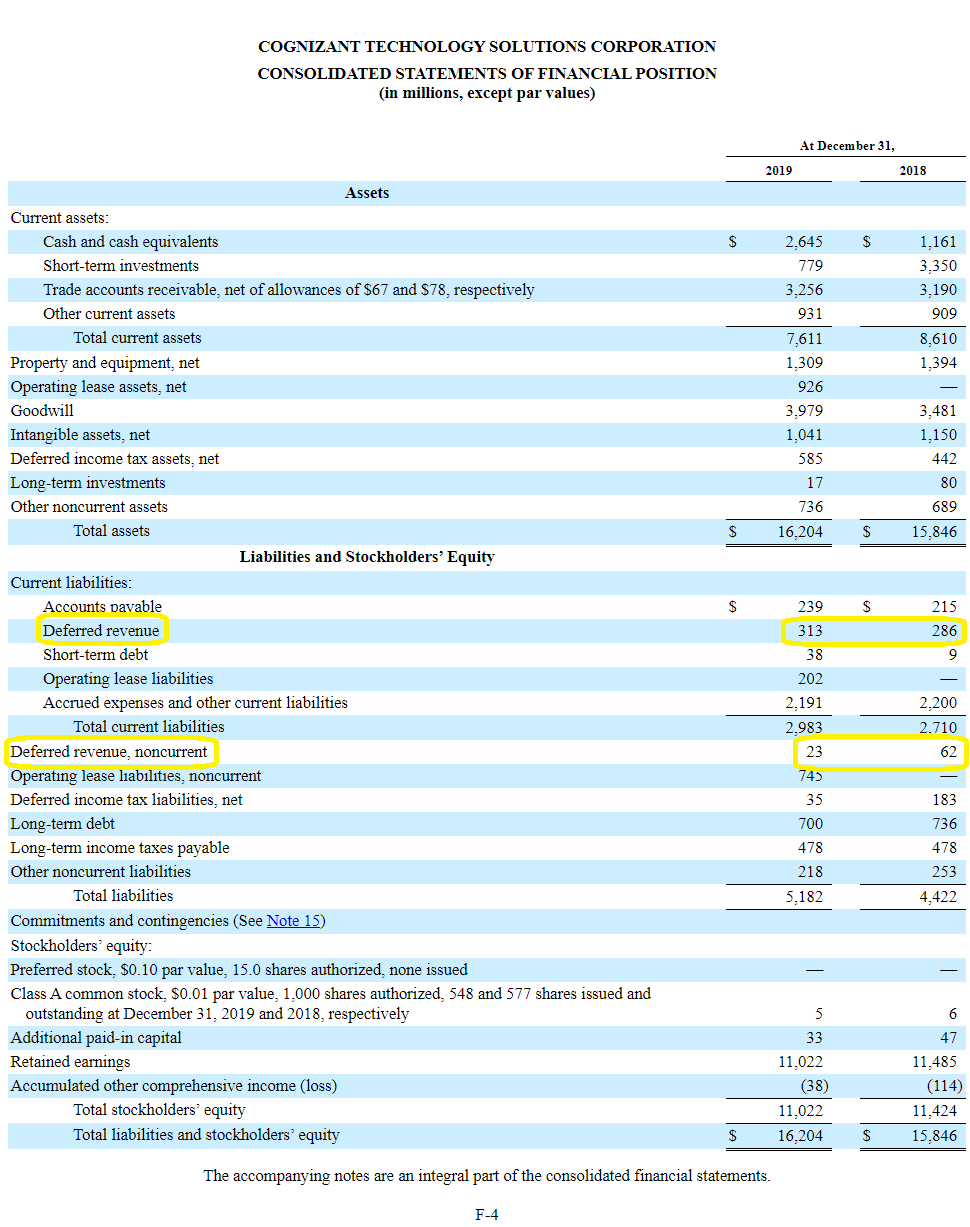

Deferred Revenue Accounting, Definition, Example

Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. How does deferred revenue impact a. Deferred revenue appears on the balance sheet as a liability, reflecting obligations to.

What Is Deferred Revenue? Complete Guide Pareto Labs

Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or. How does deferred revenue impact a. Deferred revenue appears on the balance sheet as a liability, reflecting obligations to.

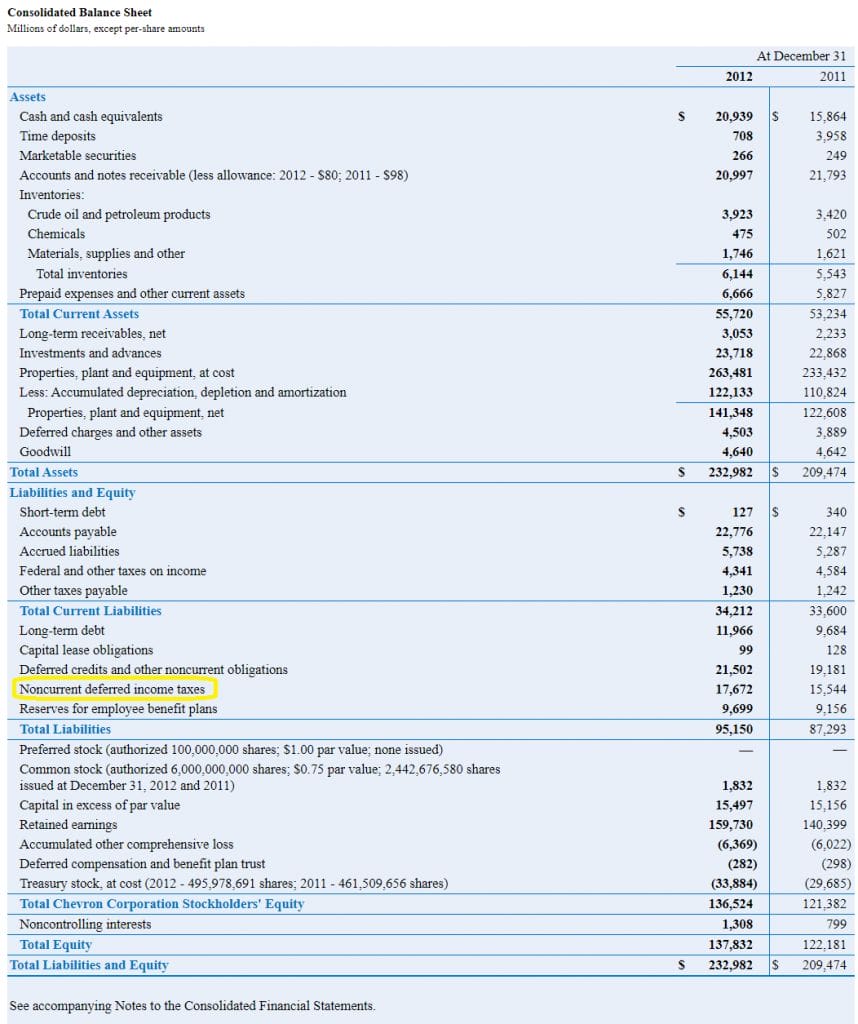

Deferred tax and temporary differences The Footnotes Analyst

How does deferred revenue impact a. Deferred revenue appears on the balance sheet as a liability, reflecting obligations to deliver goods or services. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. Deferred revenue is recorded on the balance sheet as a liability because it represents a.

Deferred Tax Liabilities Explained (with RealLife Example in a

Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or. Deferred revenue is recorded on the balance sheet as a liability because it represents a future obligation to deliver.

What is Deferred Revenue? The Ultimate Guide (2022)

Deferred revenue appears on the balance sheet as a liability, reflecting obligations to deliver goods or services. How does deferred revenue impact a. Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or. Deferred revenue is recorded on the balance sheet as a liability because it represents a future obligation to.

Deferred Revenue A Simple Model

Deferred revenue appears on the balance sheet as a liability, reflecting obligations to deliver goods or services. Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or. How does deferred revenue impact a. Deferred revenue is recorded on the balance sheet as a liability because it represents a future obligation to.

What is Unearned Revenue? QuickBooks Canada Blog

How does deferred revenue impact a. Deferred revenue is recorded on the balance sheet as a liability because it represents a future obligation to deliver products or. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. Deferred revenue appears on the balance sheet as a liability, reflecting.

Deferred Revenue Appears As A Liability On The Balance Sheet Because It Represents An Obligation To Deliver Goods Or.

How does deferred revenue impact a. Deferred revenue appears on the balance sheet as a liability, reflecting obligations to deliver goods or services. Deferred revenue is recorded on the balance sheet as a liability because it represents a future obligation to deliver products or. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until.