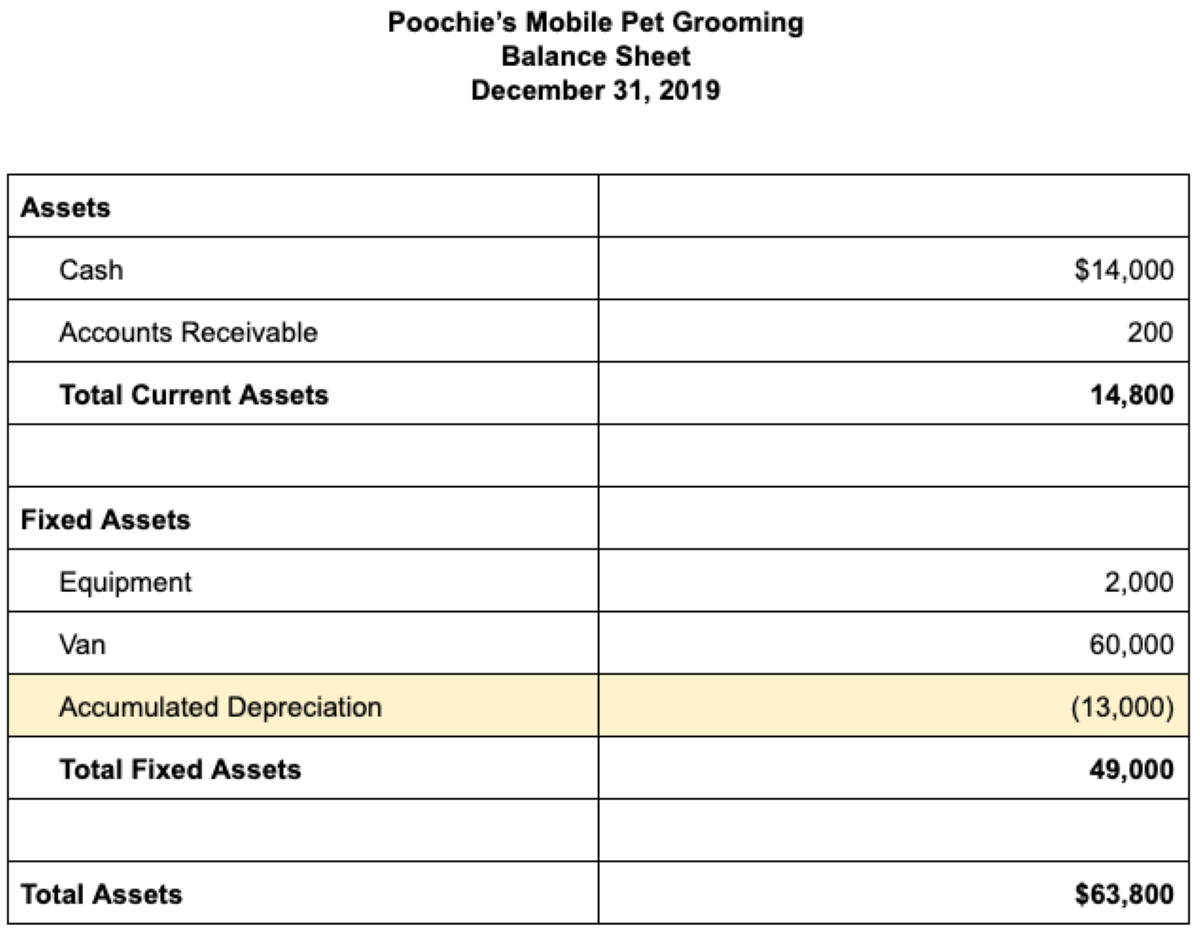

Where Does Depreciation Go On The Balance Sheet - Accumulated depreciation is recorded on the balance sheet as a contra asset account, offsetting the related asset account. As accumulated depreciation applies to fixed assets, it will be on the portion of the balance sheet detailing all the fixed assets. Depreciation expense itself does not appear as a separate line item on the balance sheet. Instead, it affects the value of the asset.

Accumulated depreciation is recorded on the balance sheet as a contra asset account, offsetting the related asset account. Depreciation expense itself does not appear as a separate line item on the balance sheet. Instead, it affects the value of the asset. As accumulated depreciation applies to fixed assets, it will be on the portion of the balance sheet detailing all the fixed assets.

Instead, it affects the value of the asset. As accumulated depreciation applies to fixed assets, it will be on the portion of the balance sheet detailing all the fixed assets. Depreciation expense itself does not appear as a separate line item on the balance sheet. Accumulated depreciation is recorded on the balance sheet as a contra asset account, offsetting the related asset account.

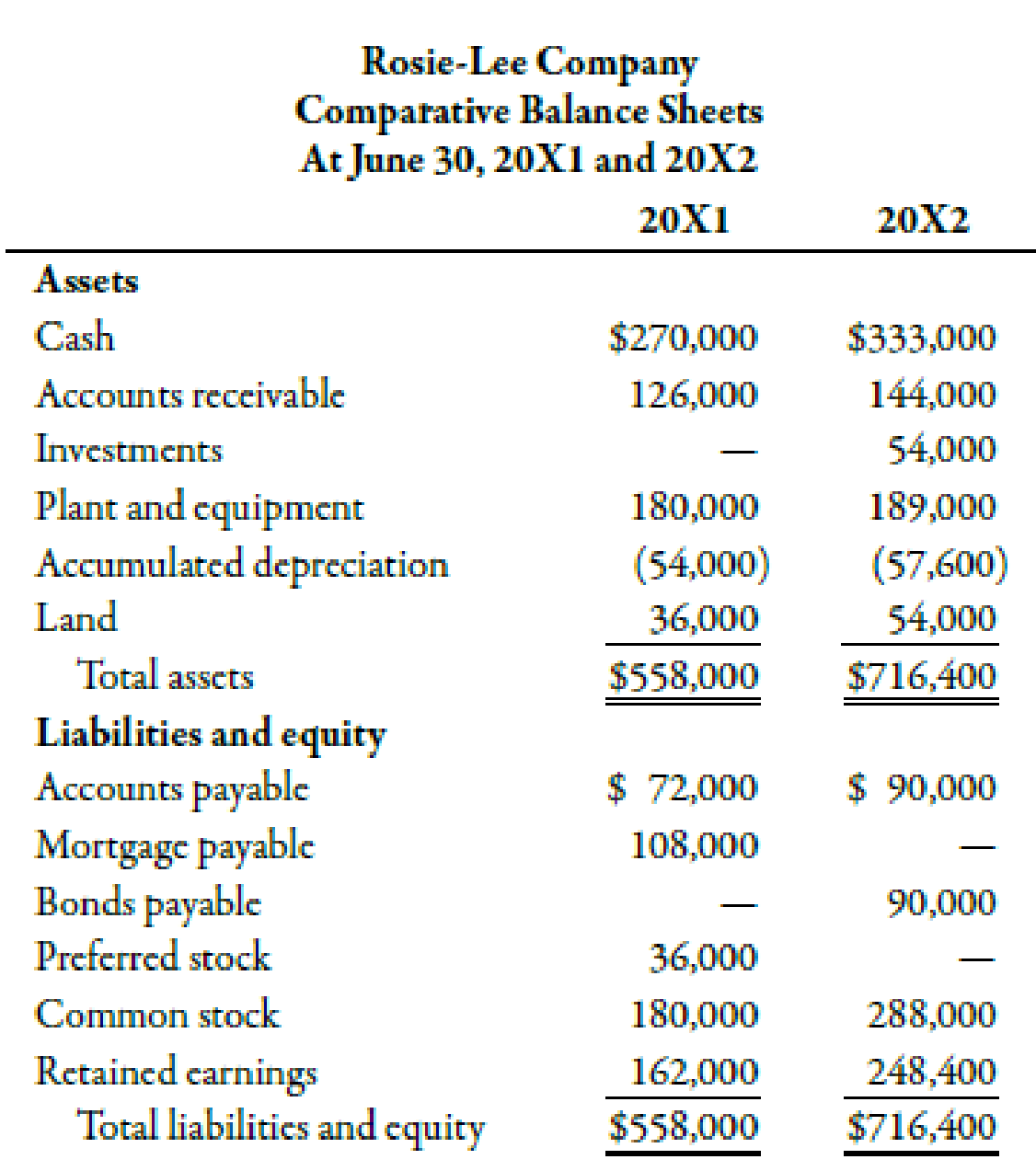

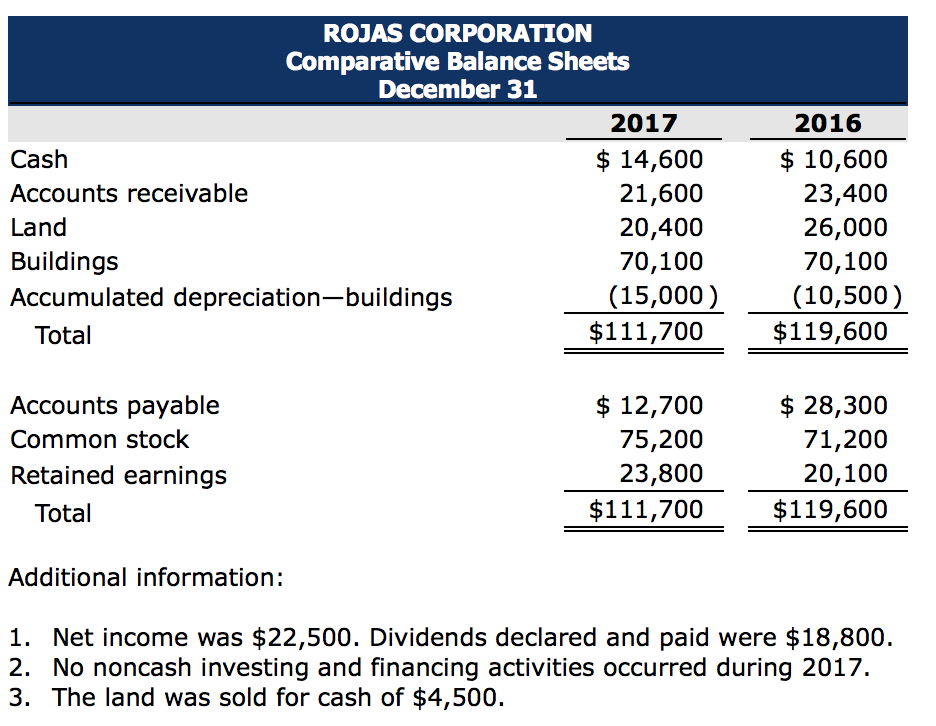

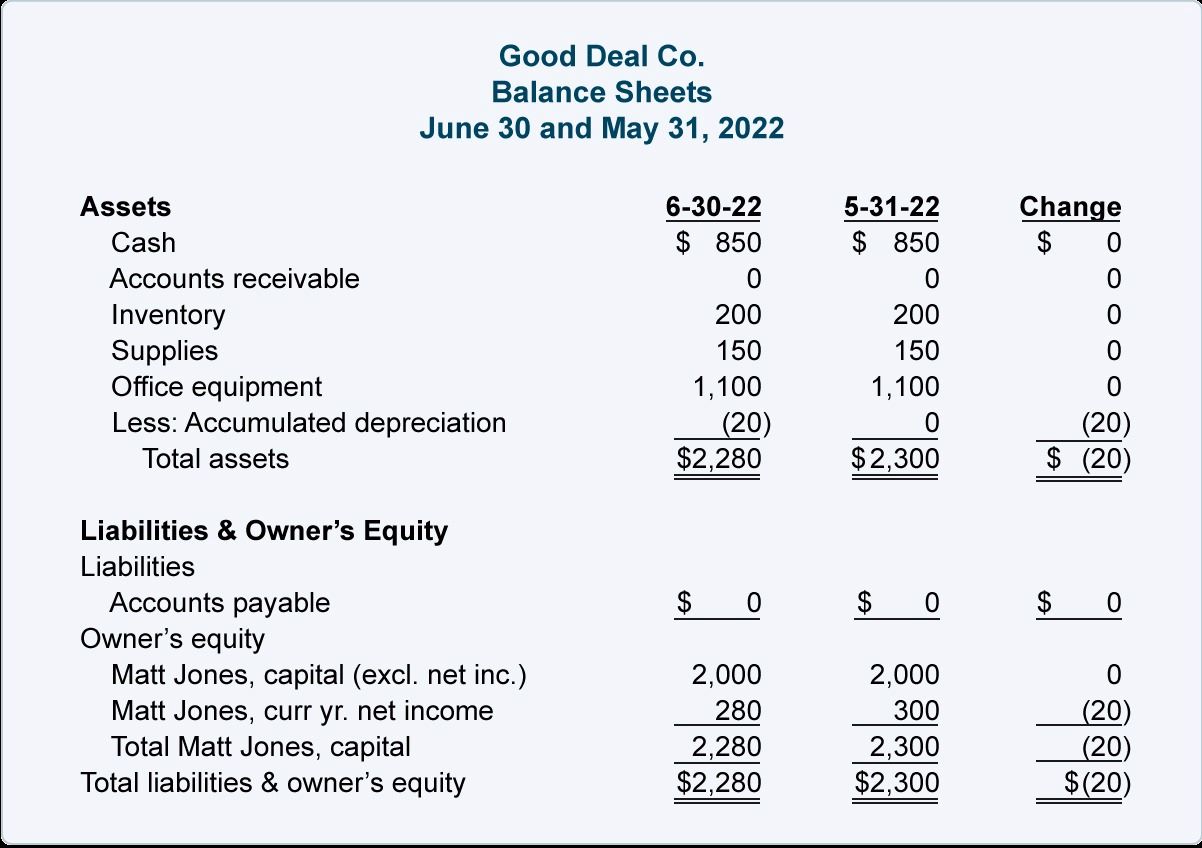

Balance Sheet Example With Depreciation

Depreciation expense itself does not appear as a separate line item on the balance sheet. Instead, it affects the value of the asset. As accumulated depreciation applies to fixed assets, it will be on the portion of the balance sheet detailing all the fixed assets. Accumulated depreciation is recorded on the balance sheet as a contra asset account, offsetting the.

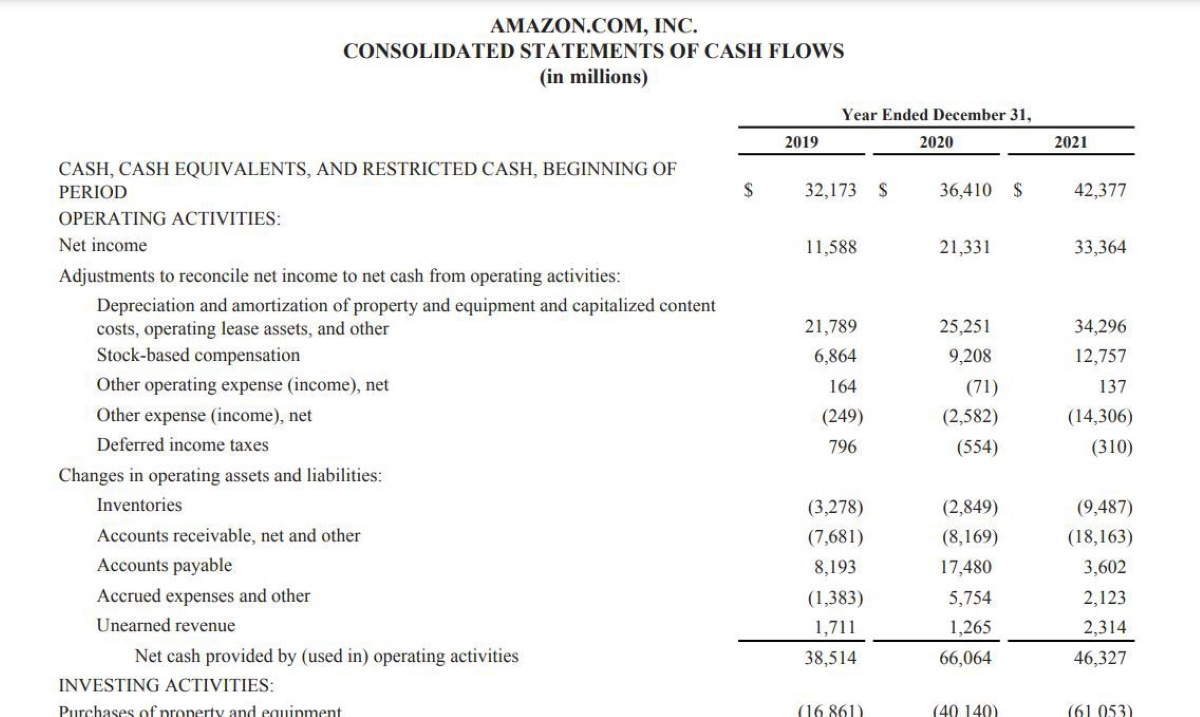

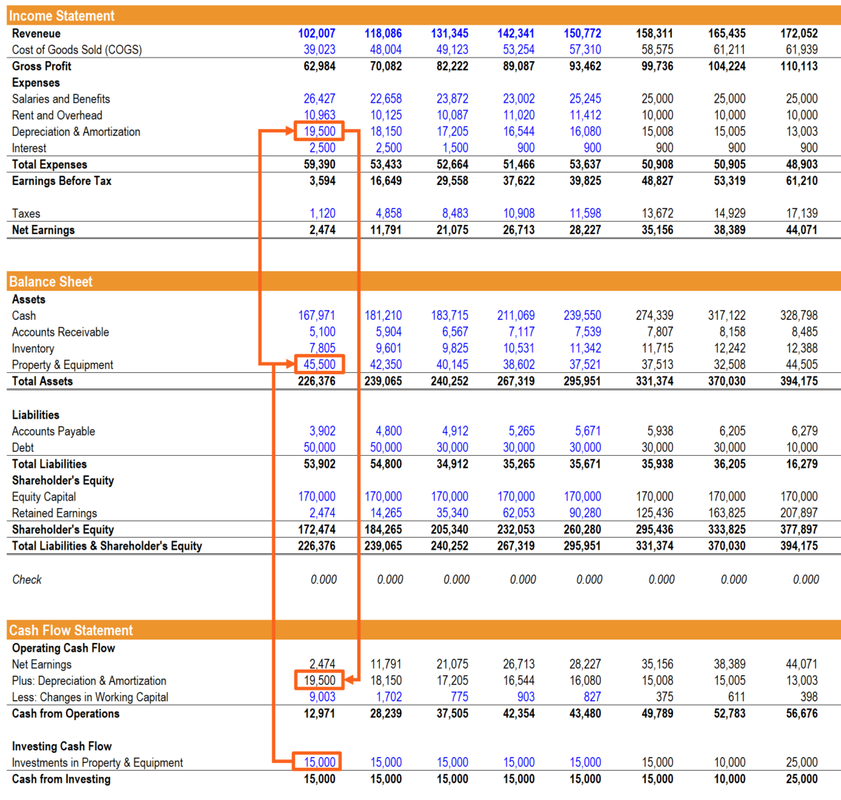

Depreciation

As accumulated depreciation applies to fixed assets, it will be on the portion of the balance sheet detailing all the fixed assets. Instead, it affects the value of the asset. Accumulated depreciation is recorded on the balance sheet as a contra asset account, offsetting the related asset account. Depreciation expense itself does not appear as a separate line item on.

Balance Sheet Example With Depreciation

As accumulated depreciation applies to fixed assets, it will be on the portion of the balance sheet detailing all the fixed assets. Depreciation expense itself does not appear as a separate line item on the balance sheet. Accumulated depreciation is recorded on the balance sheet as a contra asset account, offsetting the related asset account. Instead, it affects the value.

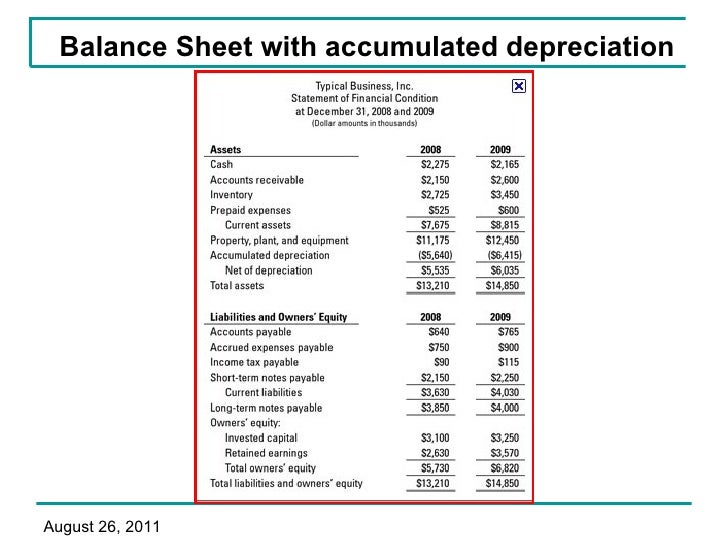

Where Is Accumulated Depreciation on the Balance Sheet?

Accumulated depreciation is recorded on the balance sheet as a contra asset account, offsetting the related asset account. Depreciation expense itself does not appear as a separate line item on the balance sheet. Instead, it affects the value of the asset. As accumulated depreciation applies to fixed assets, it will be on the portion of the balance sheet detailing all.

Where Does Depreciation Expense Go On A Balance Sheet LiveWell

Depreciation expense itself does not appear as a separate line item on the balance sheet. As accumulated depreciation applies to fixed assets, it will be on the portion of the balance sheet detailing all the fixed assets. Accumulated depreciation is recorded on the balance sheet as a contra asset account, offsetting the related asset account. Instead, it affects the value.

Where Does Depreciation Expense Go On A Balance Sheet LiveWell

As accumulated depreciation applies to fixed assets, it will be on the portion of the balance sheet detailing all the fixed assets. Instead, it affects the value of the asset. Accumulated depreciation is recorded on the balance sheet as a contra asset account, offsetting the related asset account. Depreciation expense itself does not appear as a separate line item on.

Why is accumulated depreciation a credit balance?

Instead, it affects the value of the asset. As accumulated depreciation applies to fixed assets, it will be on the portion of the balance sheet detailing all the fixed assets. Depreciation expense itself does not appear as a separate line item on the balance sheet. Accumulated depreciation is recorded on the balance sheet as a contra asset account, offsetting the.

Balance Sheet Example With Depreciation

Depreciation expense itself does not appear as a separate line item on the balance sheet. Instead, it affects the value of the asset. Accumulated depreciation is recorded on the balance sheet as a contra asset account, offsetting the related asset account. As accumulated depreciation applies to fixed assets, it will be on the portion of the balance sheet detailing all.

How do you account for depreciation on a balance sheet? Leia aqui Is

Depreciation expense itself does not appear as a separate line item on the balance sheet. Accumulated depreciation is recorded on the balance sheet as a contra asset account, offsetting the related asset account. Instead, it affects the value of the asset. As accumulated depreciation applies to fixed assets, it will be on the portion of the balance sheet detailing all.

Where Does Depreciation Expense Go On A Balance Sheet LiveWell

Accumulated depreciation is recorded on the balance sheet as a contra asset account, offsetting the related asset account. As accumulated depreciation applies to fixed assets, it will be on the portion of the balance sheet detailing all the fixed assets. Instead, it affects the value of the asset. Depreciation expense itself does not appear as a separate line item on.

Depreciation Expense Itself Does Not Appear As A Separate Line Item On The Balance Sheet.

Accumulated depreciation is recorded on the balance sheet as a contra asset account, offsetting the related asset account. As accumulated depreciation applies to fixed assets, it will be on the portion of the balance sheet detailing all the fixed assets. Instead, it affects the value of the asset.

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)