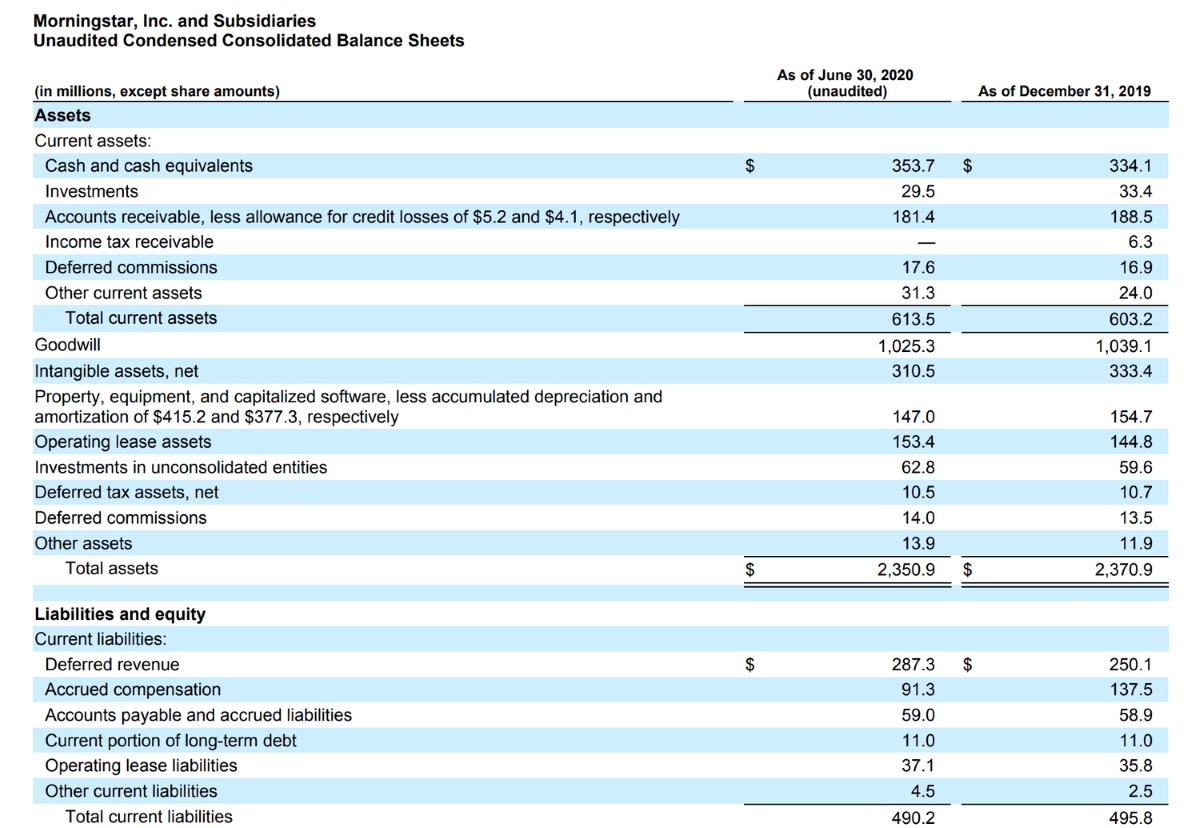

Where Does Unearned Revenue Go On The Balance Sheet - It does not initially appear on the income. Does unearned revenue go on the balance sheet? Initially, the full amount will be recognized as unearned revenue on amazon’s balance sheet. Unearned revenue is recorded on a company’s balance sheet as a liability because it represents a debt owed to the customer. However, at the end of the first month, the. Yes, unearned revenue is recorded on the balance sheet as a liability. Unearned revenue or deferred revenue appears as a liability on the balance sheet. Here we discuss how to account for unearned revenue on balance sheet with examples &. Guide to what is unearned revenue & its definition.

Here we discuss how to account for unearned revenue on balance sheet with examples &. It does not initially appear on the income. Does unearned revenue go on the balance sheet? Guide to what is unearned revenue & its definition. Unearned revenue or deferred revenue appears as a liability on the balance sheet. However, at the end of the first month, the. Yes, unearned revenue is recorded on the balance sheet as a liability. Unearned revenue is recorded on a company’s balance sheet as a liability because it represents a debt owed to the customer. Initially, the full amount will be recognized as unearned revenue on amazon’s balance sheet.

Unearned revenue is recorded on a company’s balance sheet as a liability because it represents a debt owed to the customer. Yes, unearned revenue is recorded on the balance sheet as a liability. Does unearned revenue go on the balance sheet? Unearned revenue or deferred revenue appears as a liability on the balance sheet. It does not initially appear on the income. Initially, the full amount will be recognized as unearned revenue on amazon’s balance sheet. Here we discuss how to account for unearned revenue on balance sheet with examples &. Guide to what is unearned revenue & its definition. However, at the end of the first month, the.

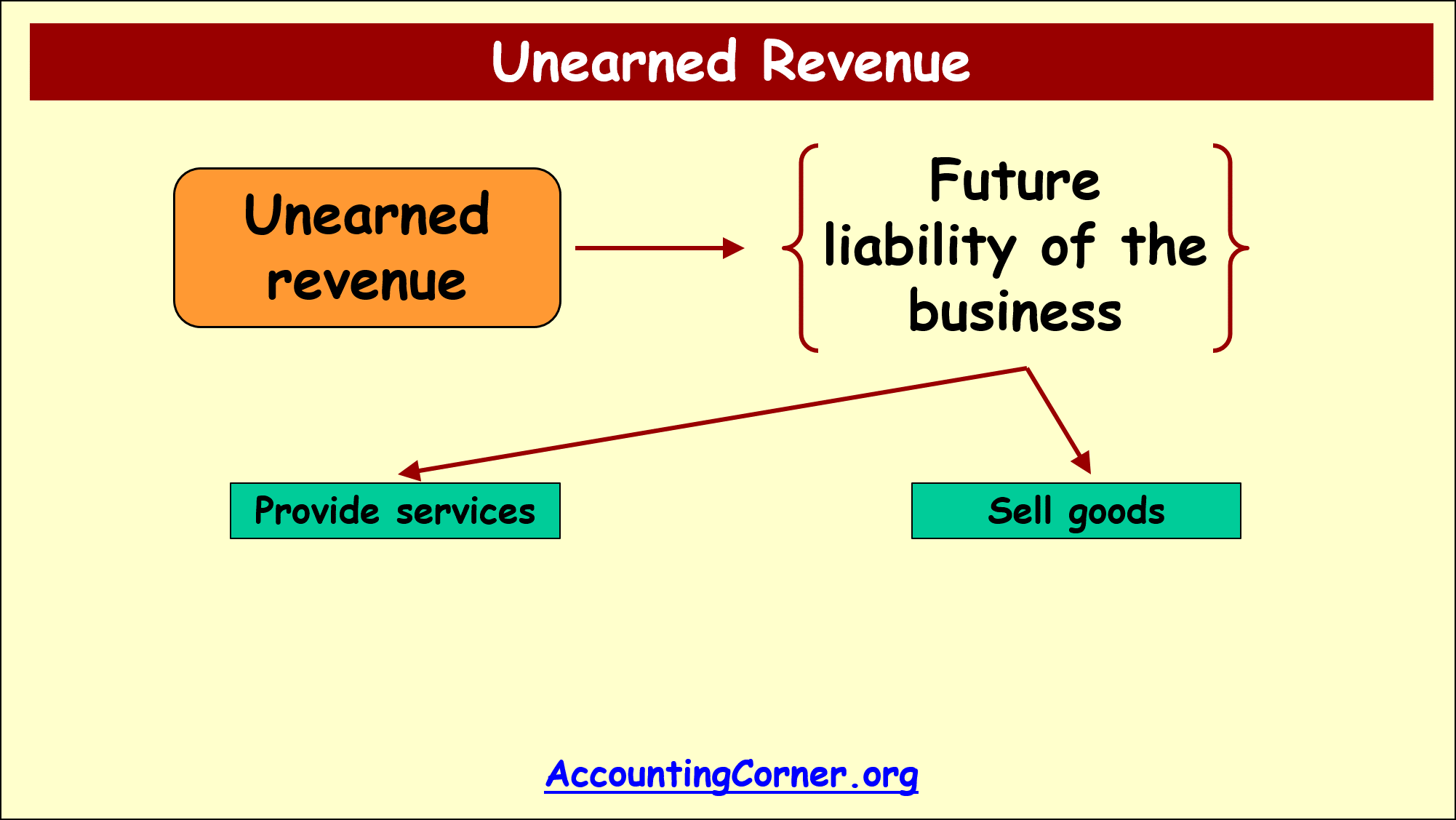

Define Common Liability Accounts Unearned Sales Revenue

Unearned revenue or deferred revenue appears as a liability on the balance sheet. Guide to what is unearned revenue & its definition. However, at the end of the first month, the. Yes, unearned revenue is recorded on the balance sheet as a liability. Unearned revenue is recorded on a company’s balance sheet as a liability because it represents a debt.

Unearned Revenue Definition, How To Record, Example

Guide to what is unearned revenue & its definition. Yes, unearned revenue is recorded on the balance sheet as a liability. However, at the end of the first month, the. Does unearned revenue go on the balance sheet? It does not initially appear on the income.

What is Unearned Revenue? A Complete Guide Pareto Labs

Unearned revenue or deferred revenue appears as a liability on the balance sheet. However, at the end of the first month, the. Yes, unearned revenue is recorded on the balance sheet as a liability. Guide to what is unearned revenue & its definition. Initially, the full amount will be recognized as unearned revenue on amazon’s balance sheet.

What is Unearned Revenue? QuickBooks Australia

Unearned revenue or deferred revenue appears as a liability on the balance sheet. However, at the end of the first month, the. Does unearned revenue go on the balance sheet? Unearned revenue is recorded on a company’s balance sheet as a liability because it represents a debt owed to the customer. Initially, the full amount will be recognized as unearned.

Where Is Unearned Revenue On The Balance Sheet LiveWell

It does not initially appear on the income. Here we discuss how to account for unearned revenue on balance sheet with examples &. Does unearned revenue go on the balance sheet? Initially, the full amount will be recognized as unearned revenue on amazon’s balance sheet. Unearned revenue is recorded on a company’s balance sheet as a liability because it represents.

What is Unearned Revenue? QuickBooks Canada Blog

Here we discuss how to account for unearned revenue on balance sheet with examples &. Unearned revenue or deferred revenue appears as a liability on the balance sheet. It does not initially appear on the income. Unearned revenue is recorded on a company’s balance sheet as a liability because it represents a debt owed to the customer. Does unearned revenue.

Is unearned revenue a revenue? Leia aqui What is unearned revenue

Guide to what is unearned revenue & its definition. Initially, the full amount will be recognized as unearned revenue on amazon’s balance sheet. Yes, unearned revenue is recorded on the balance sheet as a liability. Unearned revenue is recorded on a company’s balance sheet as a liability because it represents a debt owed to the customer. Here we discuss how.

How To Find Total Revenue On Balance Sheet LiveWell

Yes, unearned revenue is recorded on the balance sheet as a liability. However, at the end of the first month, the. Here we discuss how to account for unearned revenue on balance sheet with examples &. It does not initially appear on the income. Unearned revenue or deferred revenue appears as a liability on the balance sheet.

What Is Unearned Revenue? How Does It Work?

Guide to what is unearned revenue & its definition. Unearned revenue or deferred revenue appears as a liability on the balance sheet. Initially, the full amount will be recognized as unearned revenue on amazon’s balance sheet. Does unearned revenue go on the balance sheet? Here we discuss how to account for unearned revenue on balance sheet with examples &.

Unearned Revenue Accounting Corner

However, at the end of the first month, the. Guide to what is unearned revenue & its definition. Here we discuss how to account for unearned revenue on balance sheet with examples &. Unearned revenue is recorded on a company’s balance sheet as a liability because it represents a debt owed to the customer. Yes, unearned revenue is recorded on.

Guide To What Is Unearned Revenue & Its Definition.

However, at the end of the first month, the. Initially, the full amount will be recognized as unearned revenue on amazon’s balance sheet. Here we discuss how to account for unearned revenue on balance sheet with examples &. Yes, unearned revenue is recorded on the balance sheet as a liability.

Unearned Revenue Is Recorded On A Company’s Balance Sheet As A Liability Because It Represents A Debt Owed To The Customer.

Unearned revenue or deferred revenue appears as a liability on the balance sheet. It does not initially appear on the income. Does unearned revenue go on the balance sheet?